Image

After posting the highest return in its history a year ago, the market volatility of the last year contributed to a $3.3 billion dip in value for the Massachusetts state pension fund in fiscal year 2022, a performance that officials described as strong given "the weakest market since the global financial crisis more than thirteen years ago."

The -3.4 percent return net of fees dropped the Pension Reserves Investment Trust fund from its record-high value of $95.7 billion at the end of fiscal year 2021 to $92.4 billion, but it outperformed the fund's benchmark by 1.5 percent and officials described the performance as a strong result "during the weakest market since the Global Financial Crisis (GFC) more than thirteen years ago." The retirement funds of state employees, teachers and many municipal employees in Massachusetts are invested through PRIM.

Michael Trotsky, executive director and chief investment officer of the Massachusetts Pension Reserves Investment Management Board, presented the fund performance report during a meeting of PRIM's Investment Committee on Tuesday morning.

"Performing strongly in both up and down markets is the hallmark of a well-constructed portfolio with proven, skillful managers," Trotsky said, according to a written copy of his remarks. "The challenges during the fiscal year were unusual and unexpected. Continuing COVID flare-ups with new variants worldwide, rising interest rates, inflation at multi-decade highs, the Russian invasion of Ukraine, supply chain disruptions, food and energy shortages, labor constraints, and economies worldwide that, at best, are teetering on the edge of recession, provided a backdrop too much for markets to bear."

While the PRIT Fund took a 3.4 percent hit in fiscal year 2022, U.S. stocks were down 10.6 percent, developed international stocks were down 17.7 percent, emerging markets stocks were down 25.2 percent, diversified bonds were down 10.3 percent, and 60/40 mix of global stocks and bonds was down 13.5 percent, Trotsky said. S&P Global Ratings estimated earlier this year that the typical public pension investment performance for fiscal year 2022 would be a drop of about 7 percent.

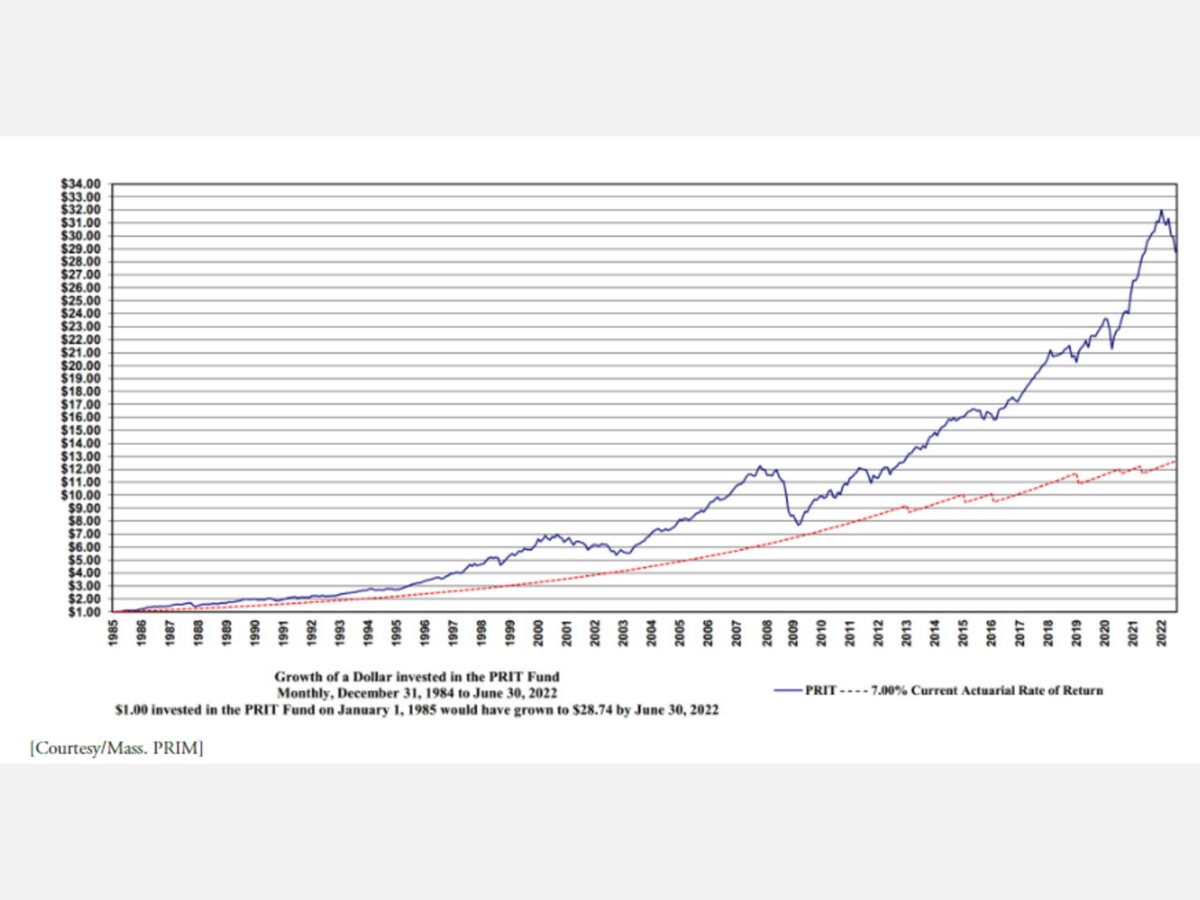

Materials that Trotsky presented to the PRIM board committee meeting Tuesday show that $1 invested in the PRIT Fund on January 1, 1985 would have grown to $28.74 by June 30, 2022. - Colin A. Young/SHNS | 8/2/22 3:20 PM