Don’t let the turbulent election upend your financial future

Don’t let the turbulent election upend your financial future

By David Shapiro, Financial Advisor & Regional Director of Wealth

Between the barrage of ads, non-stop news coverage, and the rapidly approaching date of November 5, it is almost impossible to avoid the 2024 election season roller coaster. And for the hundreds of thousands of Massachusetts residents nearing retirement, it’s just as hard not to worry about how it will impact their financial future.

Both parties are wrestling for control of Washington while weighing deeply different economic visions on topics ranging from tariffs to tax cuts. We, as Americans, have an uncertain future ahead of us, and because of that, you may think now is the wrong time to effectively invest.

But like the election, the answer isn’t that simple if you want to protect what you’ve saved or still help it grow.

In fact, a recent survey concluded that 50 percent of respondents agreed that the election outcome will directly impact their personal finances. A massive 80 percent also agreed that their financial situation will be worse if their preferred candidate loses.

So, for those balancing high costs while working tirelessly to save for retirement, an unpredictable election with seemingly unforeseen impacts on the stock market and economy only makes life more stressful.

Fortunately, there are steps everyone can take – from young professionals just starting their careers to older folks looking to retire in the next few years – to set aside the stressful election commentary and focus on saving for the future.

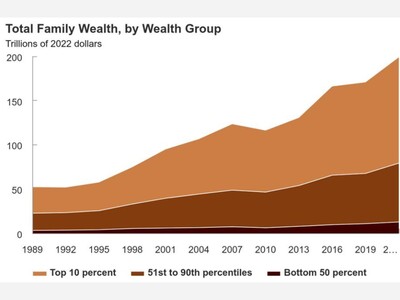

First, contrary to popular belief, U.S. election results do not dramatically impact the stock market in the long-term. Average investment returns are nearly identical in election and non-election years and more than 80 percent of election years have witnessed positive returns. The fact is, fundamental economic indicators, ranging from corporate earnings to interest rates, have the greatest impact on the stock market whether or not it is an election year.

Even if people struggle to believe that elections do not have an outsized impact on the market and ultimately, their savings, a second step folks should take this season to navigate retirement and investment planning is cliché, but true: Practice patience, patience, and more patience.

While a presidential candidate’s leaked policy proposal or rash comment made during a debate may force a sharp and immediate impact to the stock market, that impact is unlikely to last long. On average, the stock market generates positive returns every three out of four years, showing the benefits of trusting in your investments and avoiding giving into election year anxiety.

However, if those election-eve nerves continue to gnaw at spectators with years or even decades of savings, then a third piece of advice individuals should consider is analyzing the risk level of your portfolio and adjusting accordingly. For a young family that just purchased that first home or a working couple that are in their prime earning years, allowing for a higher level of risk in your investments means allowing for a higher level of reward. You can wait out one rough year on the stock market because you will have decades to make it up.

But if you have worked hard for decades, raised a wonderful family, and want to spend more time traveling and seeing your grandchildren, then it makes more sense to approach retirement planning in a more conservative manner. Seniors eagerly anticipating retirement should minimize their risk exposure, even if it means lower gains, because they want to maximize the income they will be depending on very soon.

Planning for your future and your loved ones’ future is deeply personal and unique for all. But remember, the next time you see a presidential candidate ad or hear talking heads debate a new campaign proposal, do not stress about the financial plan you have spent so long carefully crafting alongside your advisors. Instead, trust these tips, and begin thinking about something more fun: How to best take advantage of your hard-earned savings during retirement.

David Shapiro is a Financial Advisor at Johnson Brunetti, a retirement and investment specialty firm based in Needham with offices in Franklin, Norwell, and Woburn.