Report Claims a Local RE Transfer Tax Could Backfire

Cities and towns implementing new real estate transfer taxes will lose as much 60 cents for every dollar in new taxes collected while further driving down local property values and doing little to solve the state’s housing crisis, says a new report authored by the Greater Boston Real Estate Board and Building Owners and Managers Association (BOMA) International, with research assistance from the Tufts University Center for State Policy Analysis.

Indeed, the research finds, a 2 percent tax on real estate sales last year would have produced an offsetting loss of nearly 60 cents for every dollar collected, a dramatic inefficiency in the proposals put forward by Boston and other communities, the report found.

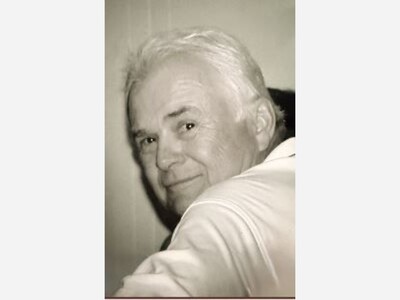

“Massachusetts needs meaningful solutions to the housing crisis and this research should tell the Governor, legislators and local leaders that new taxes won’t work,” said Mike Edward, Chair of the Greater Boston Real Estate Board and President of Perry CRE. “The Commonwealth must avoid passing misguided policies like transfer taxes and instead focus on workable solutions that promote new housing, reduce red tape and ensure the entire Commonwealth participates in a stronger housing future.”

The report, “Empowering Cities and Towns to Tackle the Housing Shortage,” highlights the negative impacts transfer taxes would have on the region’s residential and commercial real estate markets. The report notes how, for every one percentage point increase in the transfer tax, sales decline by seven or eight percent. Citing a study previously conducted by the city of Boston, “Empowering Cities and Towns” discusses how a one percent transfer tax lowers prices by one percent. Even when real estate sales are thriving, a Massachusetts community with a two percent transfer tax would lose 43 cents for every dollar they expect to raise.

The report lays out a detailed roadmap of housing solutions which will support our state’s housing needs without further impacting the economy or creating an urban death spiral in our cities. The report comes as the House of Representatives and Senate prepare to debate Governor Healey’s critical housing proposal.

“Massachusetts needs to build tens or perhaps hundreds of thousands of housing units to meet demand, so it is key that policymakers understand the right ways – and the wrong ways – to address this crisis,” said Evan Horowitz, Executive Director of the Center for State Policy Analysis at Tufts University. “Transfer taxes are a very risky approach. We really need to focus on making it easier to overcome local barriers to housing creation.”

The report suggests a number of ways the state may address the housing crisis, including:

- Expand policies similar to 40B to streamline the creation of affordable and market-rate housing units.

- Permit Accessory Dwelling Units (ADUs) by right across the state, as proposed in Governor Healey’s Housing Bond Bill.

- Tracking and overseeing existing pots of money meant for affordable housing, including funds in local housing trusts, which rarely report their activity, as well as revenue from the Community Preservation Act, which sometimes sits in municipal bank accounts.

- Reform policies such as Proposition 2 ½ to exempt affordable housing initiatives from counting towards the tax collection cap, granting communities more flexibility in their budgeting.

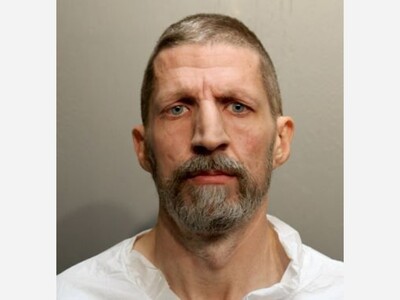

“The commercial real estate sector is as committed as anyone in wanting to see vibrant downtowns, and that vision includes affordable housing, but increasing transfer taxes is not the answer," said Don Davis, Vice President of Advocacy and Building Codes at BOMA International. "As this report shows, an increase in transfer taxes would have a devastating impact on commercial properties, and that would negatively affect local businesses and all of the jobs and revenue they generate. Particularly as local economies continue to emerge from the pandemic, this is not the right time for tax increases—we need to encourage business activity that can help downtowns thrive.”

The full report read the report here. This report and the previous GBREB/cSPA analysis of the state Community Preservation Act can be found at MAHousingSolutions.com.