Image

MTF Bulletin February 23, 2024 from the Massachusetts Taxpayer Foundation

Fiscal Year 2025 Budget: A Closer Look

Income Surtax Fiscal Impact and Spending

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan includes $1.3 billion in proposed spending supported by income surtax revenues, an increase of $300 million over the $1 billion surtax spending cap established for the FY 2024 General Appropriations Act (GAA).

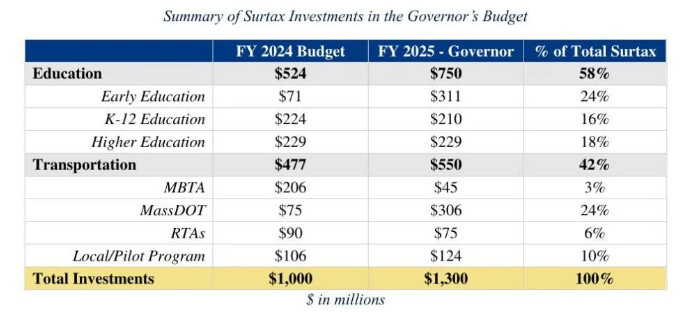

As constitutionally required, income surtax revenues are dedicated towards education and transportation investments. In FY 2025, Governor Healey proposes devoting $750 million (58 percent) towards education and $550 million (42 percent) towards transportation; and her spending plan includes several notable new investments.

There are two clear themes in Governor Healey’s surtax spending approach for FY 2025: maintaining major new programs created in recent years and beginning to develop an approach to use surtax resources to support long-term capital needs in both education and transportation.

To provide a more in-depth analysis of the Governor’s use of surtax resources and to place those resources in the context of the larger fiscal picture, this brief will provide background on how surtax spending is determined and distributed, describe notable funding proposals in Governor Healey’s budget, and compare surtax use in FY 2025 to the FY 2024 budget. The brief will conclude with key surtax-related questions that the House and Senate will need to address as they develop their own budget proposals.

FY 2025 is the second year in which the budget put on the Governor’s desk will include spending supported by surtax revenue collections. During the FY 2024 budget development process, policymakers established a process for how surtax collections would be estimated, collected, and spent. The approach that was ultimately signed into law in the final FY 2024 budget is as follows:

1. Each annual budget will cap the amount of surtax-supported spending.

The initial cap was set at $1 billion in FY 2024. In FY 2025 and FY 2026 the cap will be set through the Consensus Revenue process. After FY 2026, the cap will be increased by the 10-year rate of income growth subject to the surtax. MTF recommended the establishment of a cap on surtax supported spending to guard against overestimating collections in any given year, to build a reserve to mitigate impacts of volatility in collections, and to ensure the sustainability of surtax supported spending in the budget. The cap is purposefully set below the level of collections anticipated in any year to accomplish these three goals.

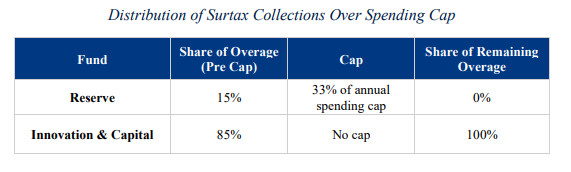

2. Revenues collected above the spending cap will be divided between two reserves.

The FY 2024 budget created the Education & Transportation Innovation & Capital Fund and the Education & Transportation Reserve Fund. The Reserve fund is intended to act as a mini-Rainy Day Fund for surtax investments, while the Innovation & Capital Fund is intended to support future capital or one-time investments. Funds are distributed between the two funds as follows:

For example, if surtax collections total $1.77 billion in FY 2025, equal to the Department of Revenue’s lower bound estimate, $470 million would be distributed between the two funds, with the reserve fund receiving $71.6 million and the Innovation & Capital Fund receiving $405.5 million. In FY 2025, the balance of the Reserve Fund is capped at $429 million (33 percent of $1.3 billion).

3. Surtax collections will be estimated by DOR and certified by the Comptroller.

DOR is required to provide quarterly estimates of surtax collections in the prior period to the Comptroller, who will then distribute estimated surtax collections among the three surtax funds. DOR must certify preliminary total collections for the prior fiscal year by December 15th . The annual Statutory Basis Financial Report, compiled by the Comptroller, will certify actual surtax spending for the prior fiscal year and identify expenditures as either education or transportation.

As part of the consensus revenue agreement, Administration, House, and Senate budget writers have established an FY 2025 surtax spending cap of $1.3 billion; an increase of $300 million over the $1 billion cap used in FY 2024. That cap is $477 million less than the Department of Revenue’s lower bound estimate for actual surtax collections in FY 2025.

Governor Healey devotes $750 million in surtax spending (58 percent) to education uses and $550 million (42 percent) to transportation. This approach is a departure from the near even split of funds between the two policy areas proposed in each iteration of the FY 2024 budget.

Governor Healey’s budget does not assume deposits into either the Reserve or Capital & Innovation trust funds in FY 2025, or in preceding years. It is likely that the Administration is waiting on better information on actual collections to estimate any deposits, but determining how much is likely to go into these funds between FY 2023 and FY 2025 will be important for budget makers to know as they move forward in their process. During the Consensus Revenue process, DOR provided both an upper and lower bound estimate of surtax collections in FY 2025. Using these estimates we can project potential deposits into the other surtax funds:

Governor Healey divides $750 million in education surtax investments between early education ($311 million), K-12 ($210 million) and higher education ($229 million). While K-12 and higher education receive the same or similar surtax funding levels as in the FY 2024 GAA, the use of surtax dollars for early education is increased by more than four times, growing from $71 million to more than $300 million.

As noted above, the Administration’s focus is on maintaining major programs created during the pandemic while the largest new initiative relates to higher education capital funding.

Maintaining Recent Initiatives ($344 million)

New Initiatives ($251 million)

Combined, the continuation of recently created programs and the Governor’s new education surtax initiatives comprise $595 million or 79 percent of total education spending. The remaining education surtax dollars are used for public higher education financial assistance ($80 million), early education provider rates ($65 million), and smaller K-12 programs ($10 million).

Governor Healey recommends $550 million in surtax spending for transportation, a $74.5 million increase over the FY 2024 GAA. This means that transportation receives just under one quarter of all new surtax spending in the Governor’s budget. Under the Governor’s proposal, transportation’s share of total surtax spending falls from 48 percent to 42 percent.

The most notable transportation proposal in the Governor’s budget is the permanent dedication of $250 million in surtax funds to the Commonwealth Transportation Fund (CTF). These funds would not be subject to appropriation and would be directly deposited into the CTF. The purpose of directing money outside of the annual budget process is to provide additional guaranteed resources to the CTF, thereby increasing its borrowing capacity to fund the transportation capital program. While the dedicated funds will increase capital spending, only a small share (estimated at $63 million) of the amount will be needed for debt service payments, freeing up the remainder for other transportation uses. The Administration proposes using the remainder of the $250 million CTF transfer as follows:

After accounting for the CTF transfer, the Governor divides the remaining $300 million in surtax transportation investments among just four areas, compared to 11 in education.

Transportation investments include:

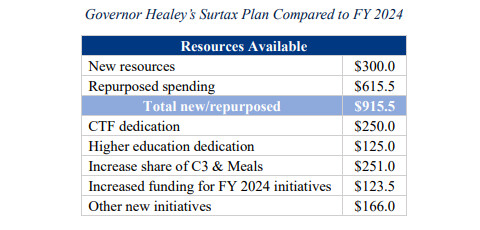

Comparing to FY 2024 Governor Healey’s budget differs significantly from the FY 2024 budget in its use of surtax dollars, with more than $900 million of her proposed spending not included in FY 2024. About one third of that difference is due to the $300 million increase in the surtax cap, but the remainder is possible because her budget repurposes $615.5 million in education and transportation surtax spending items included in the FY 2024 budget. This repurposing was largely made possible by the fact that more than half of the $1 billion in surtax spending in FY 2024 was on one-time uses or new programs supported with more than one year of funding.

As shown in the table above, the largest strategic shift in Governor Healey’s proposal is the dedication of $375 million from surtax to higher education and the CTF. In addition, she uses about $375 million to either expand surtax initiatives from last year or fund all or part of the ongoing costs of major programs created during the pandemic. The remainder of the spending (12.7 percent) goes to new initiatives.

The Administration’s decision to not continue funding a number of surtax programs from last year must be considered with two important factors in mind:

Several of the new initiatives launched in FY 2024 still have significant resources available or can be sunset or suspended after one year without an impact on planned spending. For example:

The FY 2024 budget included two MBTA surtax items with $200.8 million for MBTA capital projects and operating budget support. Governor Healey’s budget eliminates both of these items, but provides MBTA resources in other ways. The $250 million dedication to the CTF will provide $127 million for the MBTA operating budget and support about $250 million in new transportation capital spending in the next year.

While there are clear differences in programmatic priorities between the Healey administration’s spending plan and the FY 2024 budget, the biggest difference is one of strategy. For the first time, this budget proposes setting aside surtax resources for specific uses on an ongoing basis. The benefits of such a strategy are clear: they provide funding certainty and allow for long-term planning and implementation. The potential downside is also clear: decisions made today will reduce spending flexibility in the future.

Surtax use and strategy will be a major aspect of the House and Senate budget development processes, and Governor Healey’s budget provides budget writers with much food for thought. Both on a programmatic level and in terms of overall approach, the administration differs from FY 2024 and raises several important questions:

The biggest strategic surtax initiative in the Governor’s budget is to permanently dedicate a set amount of funds to transportation and higher education. Doing so will allow for better long-term planning and can maximize the ability of surtax resources to increase capital spending. However, it is also vital that dedicated amounts are chosen carefully and that there is transparency in terms of how future resources will be used. The dedication to the CTF makes sense. While lawmakers may want to increase reporting requirements or place guardrails on how those funds will be used operationally going forward, the Administration’s proposal is a smart way to increase operating and capital spending. It also makes sense to study the value of dedicating some surtax resources to growing higher education capital needs. However, a permanent dedication of funds for that purpose should await the results of that analysis.

In Governor Healey’s budget, the surtax is critical for continuing three major programs. Childcare stabilization grants, universal school meals, and MassReconnect each represent perhaps the biggest policy initiatives in early childcare, K-12, and higher education since before the pandemic.

While there will be a great deal of pressure on the House and Senate to use surtax resources to launch new initiatives, continuing these existing programs should be the top priority.

In FY 2024, the House and Senate budgets followed MTF’s recommendation to evenly split surtax spending between transportation and education. The final budget shifted the split slightly, upping the education share to 52 percent. In Governor Healey’s budget we see a further shift towards education receiving nearly 60 percent of resources. This shift is problematic. While an identical allotment may not be possible each year, it is important that both areas eligible for surtax spending receive the same attention. The importance of this is further underlined by the fact that major shortfalls in both operating and capital transportation budgets are projected as soon as FY 2026.

The House and Senate should return to the event split approach of their FY 2024 budgets