Image

The Unemployment Rate in Massachusetts reached 4 percent in November, the Commonwealth has announced, high for the Bay State, though still low compared to national numbers.

Meanwhile, the National Federation of Independent Business (NFIB), the nation's leading small business advocacy association including more than 5,000 members in the Commonwealth, reacted with alarm earlier this month to the recent state audit of the Department of Unemployment Assistance. NFIB State Director Christopher Carlozzi strongly warned that a looming UI crisis is on the horizon for employers in the Commonwealth, who pay for the system that the state administers. He got support from local business voices, too.

Employers already experienced a UI rate schedule increase to schedule C in January of 2024, and are projected to face another to schedule D in January of 2025. In addition to their regular UI taxes, business owners are paying a Covid-19 assessment to repay $2.7 billion from pandemic related layoffs. Making matters worse, it was discovered the state over withdrew $2.5 billion from the federal government and it remains uncertain whether that expense will also fall on the shoulders of the state's employers to pay.

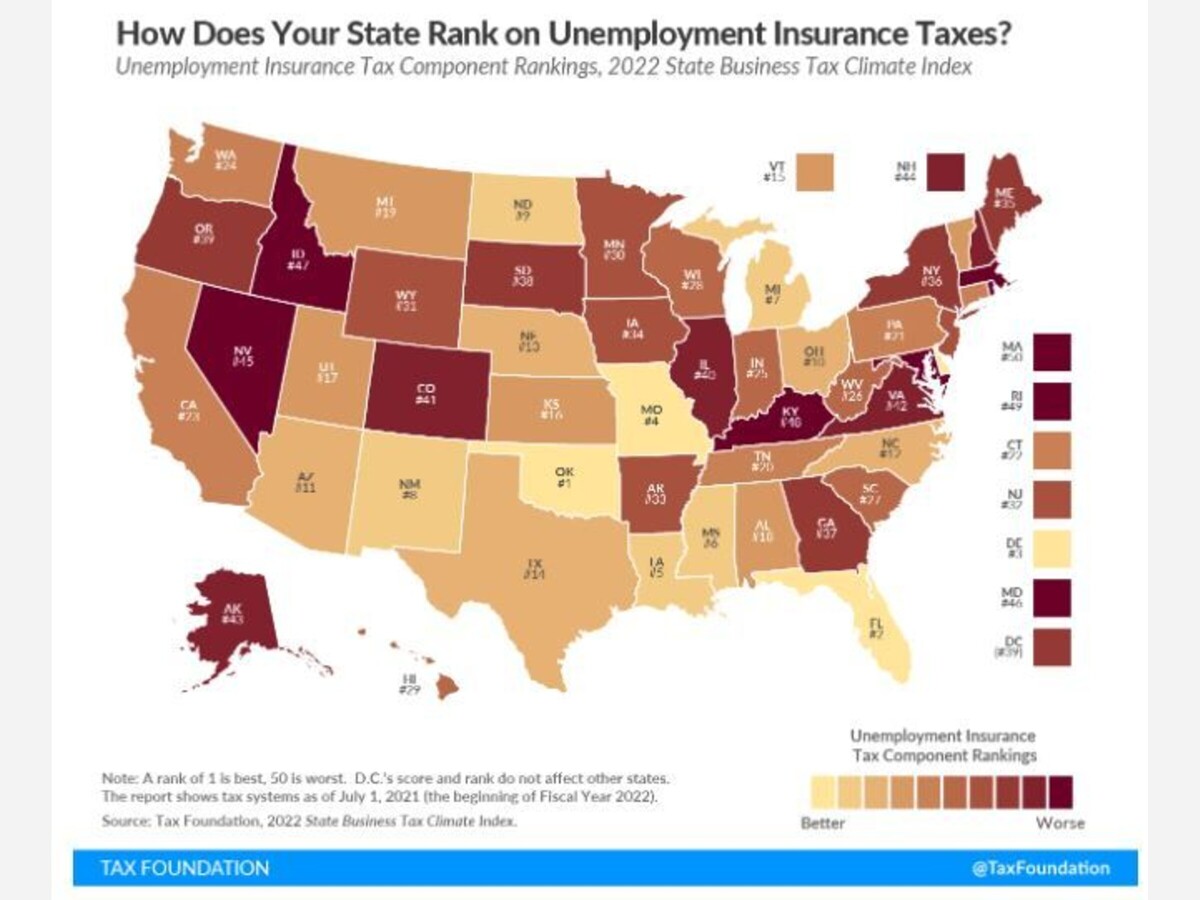

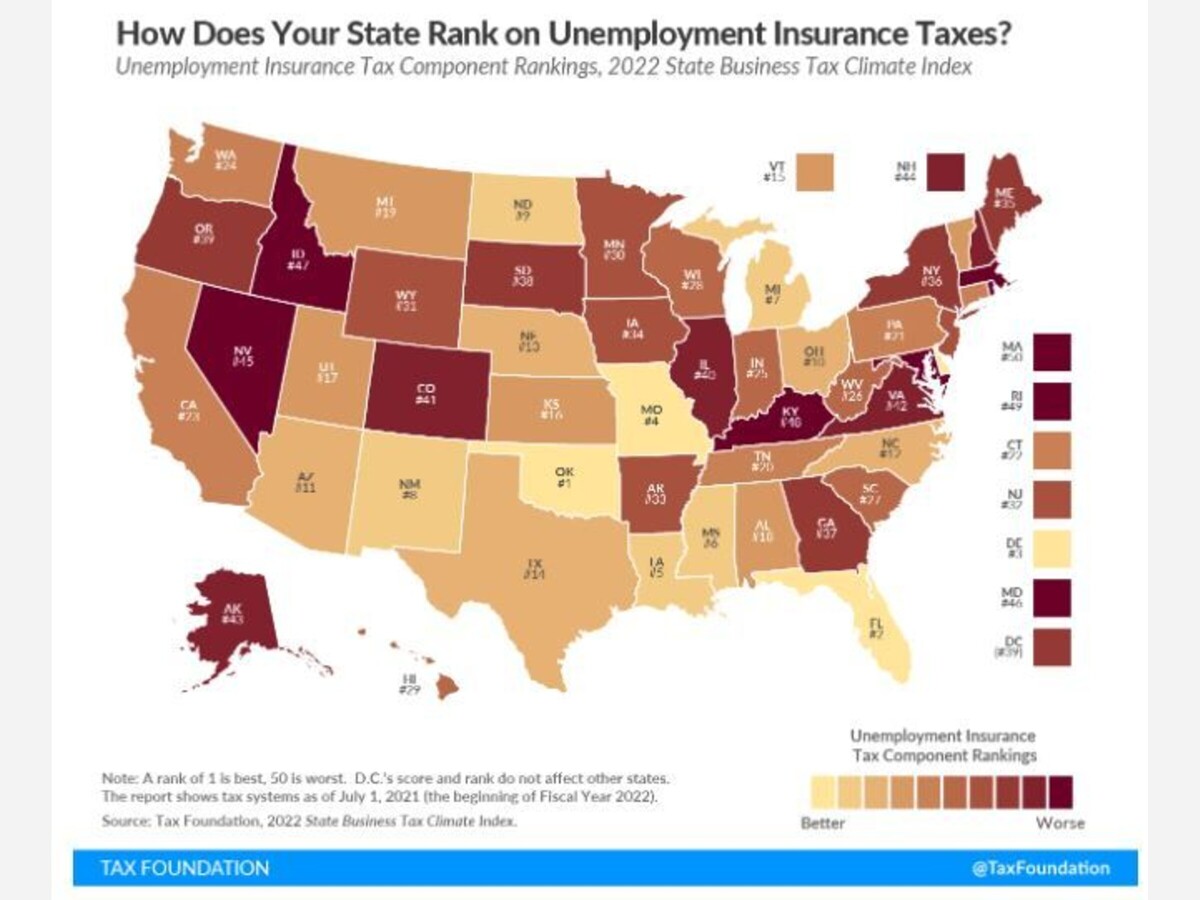

"This report underscores a need for long overdue unemployment insurance benefit and eligibility reforms. For too long the broken Massachusetts UI system has plagued employers, saddling them with some of the most burdensome taxes in the nation." said Carlozzi.

Currently, Massachusetts ranks 47th worst for UI taxes according to the Tax Foundation (https://taxfoundation.org/research/all/state/2025-state-tax-competitive…). Previous years placed Massachusetts dead last in the 50th spot.

As President of the Tri-County Regional Chamber, which serves Franklin and Medway," I’m deeply concerned about the findings in the recent state audit of the Department of Unemployment Assistance and the impact they have on our local businesses," said Laura O'Callaghan. Small businesses are already struggling to manage rising costs, workforce challenges, and the lingering effects of the pandemic, she noted Adding more financial burdens through increasing unemployment insurance taxes and mismanagement of funds is simply unsustainable.

"The $2.5 billion federal overdraw and the uncertainty about who will be responsible for repaying it only add to the frustration employers are feeling. Businesses are already dealing with a Covid-19 assessment on top of some of the highest UI taxes in the country, and these additional costs could push many to the brink," O'Callaghan said.

Tom Erb, President of Electric Time Company, a Medfield manufacturer of large, out-door clocks employing about 30 people, is also concerned. He said during Covid, the state did a poor job of policing who got benefits and at present, there are almost no limits on who can be given UI benefits. "The state needs to buckle down," he said, and make sure that employers aren't forced to pay for someone elses's $2.5 billion mistake.

"It is increasingly frustrating for employers, trying desperately to stay afloat in an already challenging environment, to witness more mismanagement of an unemployment trust funded by their tax dollars." Carlozzi continued. "They are being held financially responsible for pandemic related layoffs beyond their control, the most generous benefits in the nation, and lax eligibility requirements, all while potentially facing another assessment if the federal government fails to waive the state's $2.5 billion error. The time for lawmakers to act is now to tackle the reforms that should have been addressed during the pandemic by reining-in out-of-control benefits and setting more stringent eligibility standards to make Massachusetts less of an outlier when it comes to unemployment insurance."

"It’s time for our state leaders to step up and address these longstanding issues. We need unemployment insurance reform that balances supporting workers with creating a fairer system for employers," said O'Callaghan. That means revisiting benefit and eligibility standards and advocating for federal relief to ensure businesses aren’t left holding the bag for the state’s mistakes, she added.

"Our Chamber stands ready to work with business owners, policymakers, and organizations like the NFIB to push for meaningful change. The future of our local economy depends on it, and we can’t afford to wait any longer. Let’s get this right for everyone," O'Callaghan urged.